Enhancing Data Availability

RIMES supports Member States in enhancing monitoring networks and data management systems to ensure data availability and address gaps in multi-hazard early warning information.

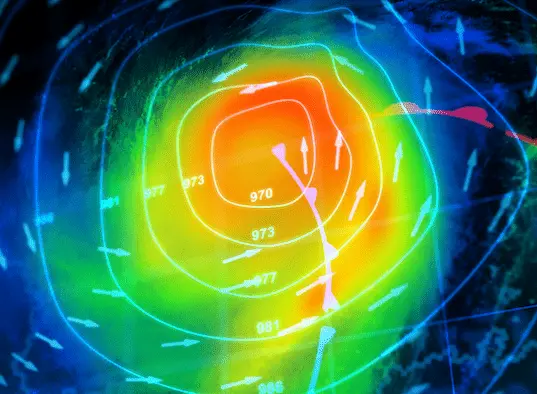

Modeling and Forecasting

RIMES co-develops models for risk and impact-based forecasting with Member States and fosters cooperation at national, regional and global levels for data sharing to improve accuracy and lead-time of forecasts.

Community Outreach & Feedback

RIMES facilitates mechanisms for empowering local institutions and communities through actionable risk information and two-way interaction for enhanced resilience.

Formulate and implement people-centered community based risk management actions, plans and protocols

Customize risk information to address societal as well as sectoral needs for information and services

Develop and implement practical measures to transform forecasts and advisories into actionable information for last mile users

Capacity Building, Research & Development

Training on local data processing and application of forecast, warning, and response communication; graduate fellowship program

RIMES supports capacity building and innovates across the early warning service delivery spectrum to deliver cost-effective and sustainable solutions in line with the national and regional priorities.

In the News

RIMES in Action

Our Recent Projects

In order to achieve RIMES' long-term goal of forearmed, forewarned, and resilient communities, RIMES works along the five pillars of the climate/weather information value chain to enhance early warning capacities in member states through various initiatives.